New Hampshire Medicare Supplement Enrollment Periods

Medicare Supplement enrollment periods are important for individuals who are enrolled in Medicare and want to add coverage for things that Original Medicare doesn't cover. These enrollment periods are set by the federal government and provide individuals with a specific window of time during which they can sign up for a Medicare Supplement plan.

The first Medicare Supplement enrollment period begins when an individual first becomes eligible for Medicare. This is called the Initial Enrollment Period (IEP) and it lasts for seven months. During this time, individuals can sign up for a Medicare Supplement plan without undergoing medical underwriting if the person is already enrolled in Original Medicare. This means that they cannot be denied coverage based on their medical history.

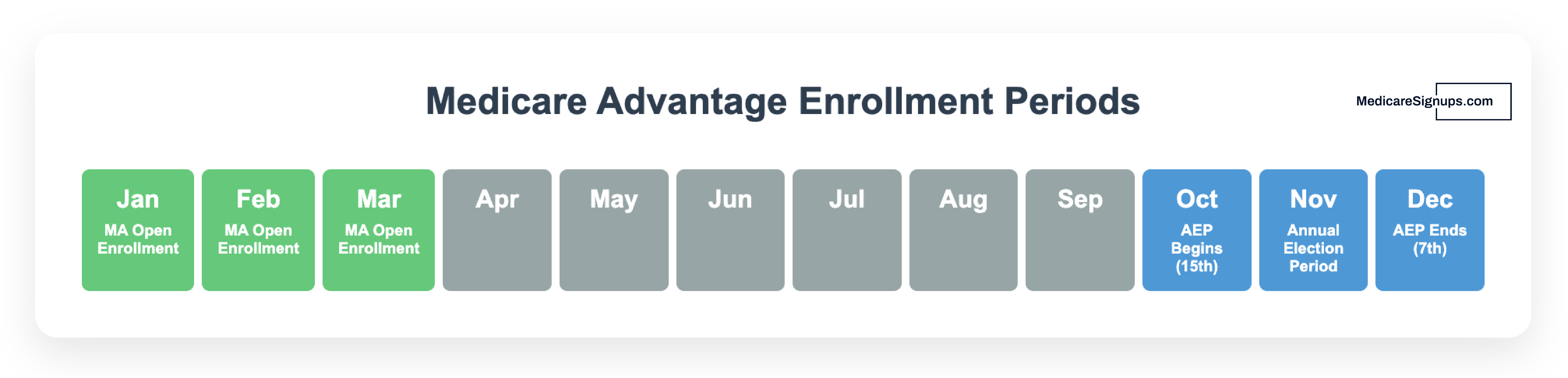

After the initial enrollment period, there are only a few other times when individuals can sign up for a Medicare Supplement plan. The most common is during the Annual Enrollment Period (AEP), which takes place each year from October 15 to December 7. During this time, individuals can switch to a different Medicare Supplement plan or enroll in a plan for the first time.

Individuals who miss their Initial Enrollment Period or the Open Enrollment Period may still be able to enroll in a Medicare Supplement plan, but they may have to undergo medical underwriting. This means that their coverage could be denied based on their medical history.

It's important for individuals who are enrolled in Medicare to be aware of these enrollment periods and to take advantage of them if they wish to add coverage for things that Original Medicare doesn't cover. Medicare Supplement plans can provide individuals with additional coverage for things like copayments, coinsurance, and deductibles, as well as coverage for medical services that Original Medicare doesn't cover. By understanding their enrollment options and taking advantage of them, individuals can ensure that they have the coverage they need to protect their health and finances.

What are my options if miss the New Hampshire Medicare Supplement Open Enrollment Period?

If you miss your Medicare Supplement open enrollment period in New Hampshire, you may still be able to enroll in a Medicare Supplement plan, but it may be more difficult and you may have to pay a higher premium. This is because NH Medicare Supplement insurance companies are not required to sell you a policy or accept you into a plan if you apply outside of your open enrollment period.

If you miss your open enrollment period, your best option is to contact Medicare Supplement insurance companies in your area to see if they are willing to sell you a policy. You may have to undergo medical underwriting, which means that the insurance company will evaluate your health history and medical conditions to determine if they will offer you coverage and at what price. If you have any pre-existing medical conditions, this may make it more difficult for you to find coverage.

Another option is to consider enrolling in a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and provide an alternative to Original Medicare. They typically include additional benefits, such as vision, dental, and hearing coverage, and may also have lower out-of-pocket costs. However, Medicare Advantage plans have network restrictions, so you will need to choose a plan that provides coverage at the hospitals and doctors you prefer to use.

If you have missed your open enrollment period and are unable to find a Medicare Supplement plan that meets your needs, you may want to consider enrolling in a Medicare Advantage plan as a temporary solution. You can always switch back to Original Medicare and a Medicare Supplement plan during the next open enrollment period.

It's important to note that if you live in New Hampshire you may not be able to switch from a Medicare Advantage plan back to Original Medicare and a Medicare Supplement plan during the next open enrollment period if you have certain medical conditions. Therefore, it's important to carefully consider all of your options before making a decision.